In this article we discuss the roles of those who may be named in a life insurance policy: primary beneficiary, co-beneficiaries, and a contingent beneficiary.[i] We will discuss the beneficiary is an organization. And what happens if it no longer exists? Let’s explore examples of these scenarios, and how you can prevent confusion for yourself and others.

Types of Beneficiaries

With a life insurance policy, the policy language names those people you have designated to receive all or part of your insurance policy benefit after your death:

- Primary beneficiary

- Co-beneficiaries (or multiple beneficiaries)

- Contingent beneficiary

- An organization as beneficiary

- A trustee of a trust or an estate

Primary Beneficiary

If you choose only one person as the beneficiary, they are the primary beneficiary. A primary beneficiary receives all the money your insurance policy pays after your death.

Co-Beneficiaries

If you want more than one person to benefit, they are co-beneficiaries or multiple beneficiaries. You assign a particular amount of the total insurance benefit to each person.

Note: Some insurance providers call multi-beneficiaries “contingent” beneficiaries. Check to ensure this assigned wording includes the beneficiary as part of the total distribution, be they primary or contingency.

An example of co-beneficiaries is your spouse, adult children, and/or siblings. They are designated beneficiaries and receive an assigned amount or percentage of the total amount of the policy’s insurance benefit.

Contingent Beneficiary

A contingent beneficiary is when a person only receives an insurance benefit if the primary is not eligible. A contingent beneficiary designation refers to the second or third or multiple person(s) after the primary beneficiary. [ii]

An example of a contingent beneficiary is a spouse named the primary beneficiary and an adult sibling of the policy is names as the contingent beneficiary. If the spouse dies, then the sibling is given the total amount.

No Contingent Beneficiary

If no contingent beneficiary has been assigned, and the primary beneficiary is deceased, the insurance benefit returns to the estate of the policyholder (the insured). If there is no living trust or will, it may go to probate.

Organization as a beneficiary

Some people want to benefit an organization, corporation, or non-profit organization, such as a charity, a school, university, a church or synagogue.

If this organization is no longer in existence, several actions may happen depending on the language of the policy, and if there are other assigned beneficiaries.

- If the organization is no longer in existence, but an organization has bought the organization or legally acquired the designated organization, the insurance benefit may go to the succeeding organization.

- If the organization was a primary designation, and no other organization has acquired it, it will go to a contingent beneficiary if one has been named.

- If there is no contingent beneficiary, the amount designated for the payout will be returned to the estate of the policyholder.

- Lastly, if an organization is one of several co-beneficiaries, and the organization no longer exists and has not been legally acquired by another organization, the other beneficiaries will receive the portion designated to the expired organization.

Speak to an agent.

Learn more about your coverage options today.

Speak with agent

If no contingent beneficiary has been assigned, and the primary beneficiary is deceased, the insurance benefit returns to the estate of the policyholder (the insured).

Can you name your estate or trust as beneficiary?

Yes, you can assign your life insurance policy benefit to your estate or trust. Please confer with a certified estate planning attorney on how this designation is handled.

Who should I not designate as a beneficiary?

It is not recommended to name any minor, or a disabled person who cannot care for themselves as a beneficiary. A person under 18 years old is considered a minor. Typically, the insurance benefit will be assigned to a probate court. There are other ways to ensure a child or a disabled person receives the money. Confer with a certified estate planning attorney for alternative methods to handle funds for either situation.

Common Practice for Designating Amounts to Beneficiaries:

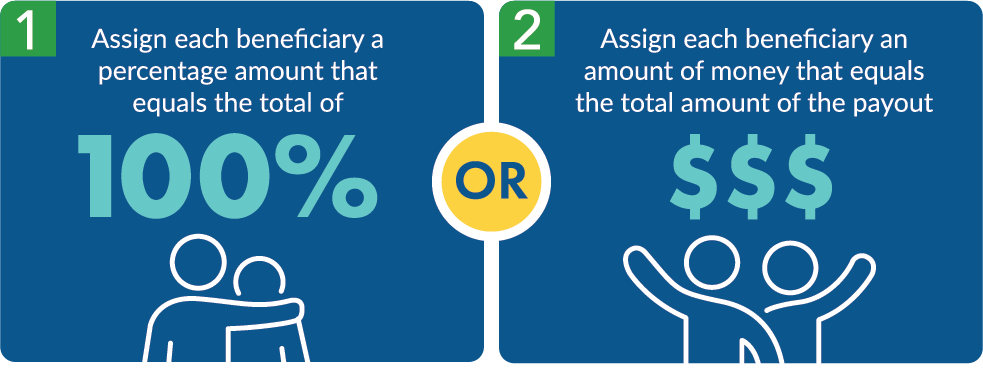

If the policyholder has selected co-beneficiaries, there are two options of how you direct the funds:

- Assign each beneficiary a percentage amount that equals the total of 100%.

- Assign each beneficiary an amount of money that equals the total amount of the payout.

A policyholder can assign these percentages or amounts as they wish. The holder may assign each person equal amounts or varied amounts.

When one of the beneficiaries dies, his or her portion is typically divided among the remaining beneficiaries.

If there are three beneficiaries, the amount the beneficiary was designated will be split between the two remaining beneficiaries.

Beneficiary example of designated amounts:

$175,000 payout- Beneficiary 1 (B1) has died. The amount designated to B1 is $100,000. Beneficiary 2 (B2) is designated $50,000, and Beneficiary 3 (B3) is designated $25,000. Upon the death of the insured, B2 and B3 will each receive half B1’s $100,000 designation. As a result, B2 will now receive $100,000 and B3 will receive $75,000 upon the insured’s death.

Beneficiary example of percentage designations:

Beneficiary 1 has died. He had been designated 40% of the total of a policy benefit. The remaining two living beneficiaries have the remaining 30% each upon the death of the insured, they will both be given half B1’s designation totaling 50% of the total insurance benefit.

Irrevocable and revocable beneficiary can make an impact on how you can or cannot make changes on your own policy.

Types of Designations in the Policy Language

- Irrevocable

- Revocable

Irrevocable means you cannot change the beneficiary or the amount or percentage of funds designated to this person or organization. It may be a spouse, and if you divorce and you have made it irrevocable, the only way the designation could be changed is if the spouse would forfeit their rights to the money. Irrevocable can also be deemed as a protective and positive decision. If you have a wife or husband who depends on your policy because they do not work out of the home and care for the family, then insuring the spouse is fully funded upon your death may be a wise choice. Children can also be included as part of the irrevocable policy, but it is recommended if the child is a minor, provisions are made to ensure their portions do not go to probate. [i]

Revocable. This means that at any time, the insurer can change the person(s) or organization(s), either removing them entirely from the insurance policy or changing the amounts of payout designated.

Annual check and updates on your policy

The best practice for ensuring all the beneficiaries on your policy are current is reviewing your life insurance policy annually. Check the beneficiaries contact information. If they have moved or have other changes, you can update your policy.

If there are changes, sudden or otherwise, calling your agent and the life insurance company is the best way to deal with ensuring your insurance policy and those loved ones or organizations are taken care of after your passing.