Supplemental employee benefits can either be a benefit provided and paid for by the employer, or a voluntary benefit provided by the employer and purchased by the employee at a group rate.

This employee benefit can serve as a cost-effective option for attracting and retaining employees. With rising healthcare expenses, supplemental employee group benefits provide another benefit for employees.

Voluntary benefits are offered by an employer or organization at a group rate, and the employee has the option to enroll with the premium conveniently deducted from their paycheck. According to a 2022 employee benefit survey, 90% of employers offer at least one voluntary benefit.1

Offer Your Employees Voluntary Benefits

Our benefits are fully-customizable and tailored to help address groups' specific needs.

Explore Our Solutions

Organizations providing benefit offerings (including supplemental benefits) for the specific needs of their employees report it has a positive impact on employees’ engagement and productivity.

Supplemental health benefits may be needed to help with group health insurance

A rise in the cost of health insurance is predicted for the 2024 plan year. Market-based reasons are an increase in prescription drugs, emergency care, and outpatient care. The top contributing factors are chronic health conditions, catastrophic claims, specialty and costly prescription drugs, and gene therapy2.

Reliable sources including PricewaterhouseCoopers’ Health Research Institute (HRI) are projecting a median 7% rise in costs for both individual and group medical markets.3

Supplemental benefits such as accident, critical illness, and hospital indemnity insurance may pay the insured a lump sum for a singular incident depending on the terms of the policy. In the case of hospital indemnity coverage, an insurance policy may pay benefits to help offset costs of hospital stays, copays, deductibles, and inpatient rehabilitation.

Supplemental medical insurance doesn’t take the place of major medical coverage but can help with additional out-of-pocket expenses otherwise not paid by major medical coverage.

Popularity of employee supplemental benefits

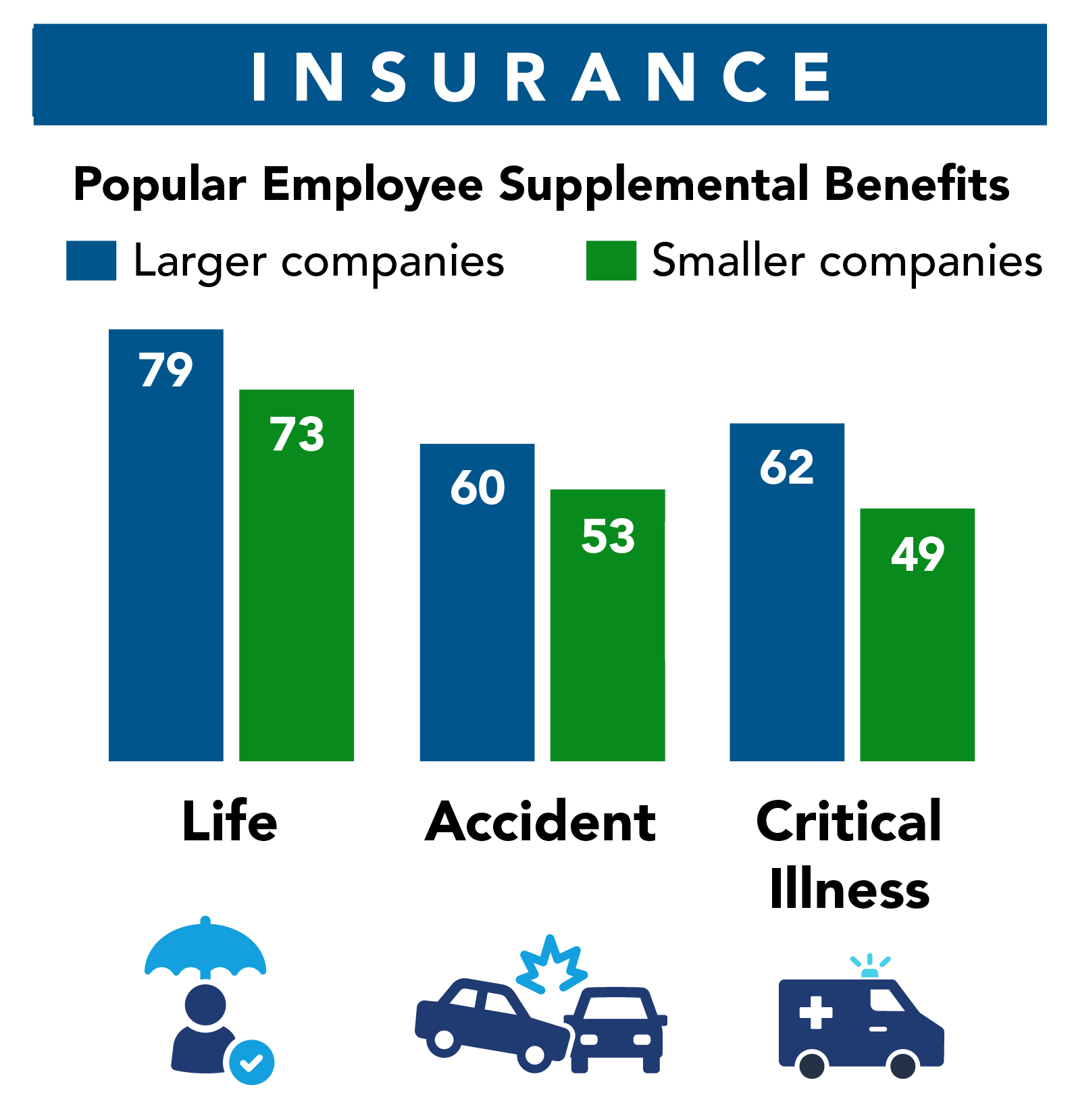

The International Foundation of Employee Benefit Plans published a 2022 Employee Benefits Survey1 from more than 500 organizations representing 20 industries of varied sizes. The survey reveals the most popular supplemental benefits offered by these organizations:

- Life insurance was the most commonly offered voluntary benefit with 79% of the larger organizations and 73% of the smaller organizations offering this supplement insurance.

- Accident insurance is also popular with those surveyed, 60% of the larger organizations and 53% of the smaller companies offered accident insurance supplemental benefits.

- Critical illness insurance was a popular benefit with 62% larger organizations and 49% of the smaller companies’ organizations surveyed offering this voluntary insurance option.

Employee benefits weigh heavily in the post-pandemic tight labor market

The workplace landscape changed during the post-pandemic period. Return-to-work programs and the substantial number of people who resigned during this period affected the labor market. Employees’ attitudes and expectations have changed toward the workplace, work-life balance, and employment benefits and services.

Employers and organizations change with those needs in order to better retain employees. Organizations providing benefit offerings (including supplemental benefits) for the specific needs of their employees report it has a positive impact on employees’ engagement and productivity.4

Adding new benefits can be daunting. Which plans should you offer? How much will they cost? How much will they save you overall? Reach out to a group benefit insurance agent who can guide you in your choice of supplemental group benefits.

Sources:

-

International Foundation of Employee Benefit Plans (IFEBP), https://ifebp.org/store/employee-benefits-survey/Pages/default.aspx, Accessed 2024.

-

Peterson-KFF-Health Tracker System, https://www.healthsystemtracker.org/brief/how-does-medical-inflation-compare-to-inflation-in-the-rest-of-the-economy, June 2023.

-

PWC.com, https://www.pwc.com/us/en/industries/health-industries/library/behind-the-numbers.html, Accessed 2024.

-

IFEBP.org, https://blog.ifebp.org/employee-attraction-and-retention-through-voluntary-benefits/, March 10, 2023.

Other Sources:

People Keep, https://www.peoplekeep.com/blog/nine-reasons-for-rising-health-care-costs, October 13, 2023.

Zavvy People Development, https://www.zavvy.io/blog/trends-in-employee-benefits ,January3, 2024.